Best investment options in Pakistan to hedge against high inflation

In order to beat inflation and really create wealth, we need to invest in assets that can offer more return than ongoing inflation. Rapid price increases can have a Hausarbeit schreiben lassen kosten destabilizing effect on an economy and jeopardize your hard-earned savings. The problem is most significant for households with fixed incomes and for retirees living on tight budgets. Over time, the pressures of inflation can diminish the purchasing power of your income, leaving you scrambling to cover rising housing costs, food prices, energy bills, and medical expenses. The results can devastate to your personal financial situation.

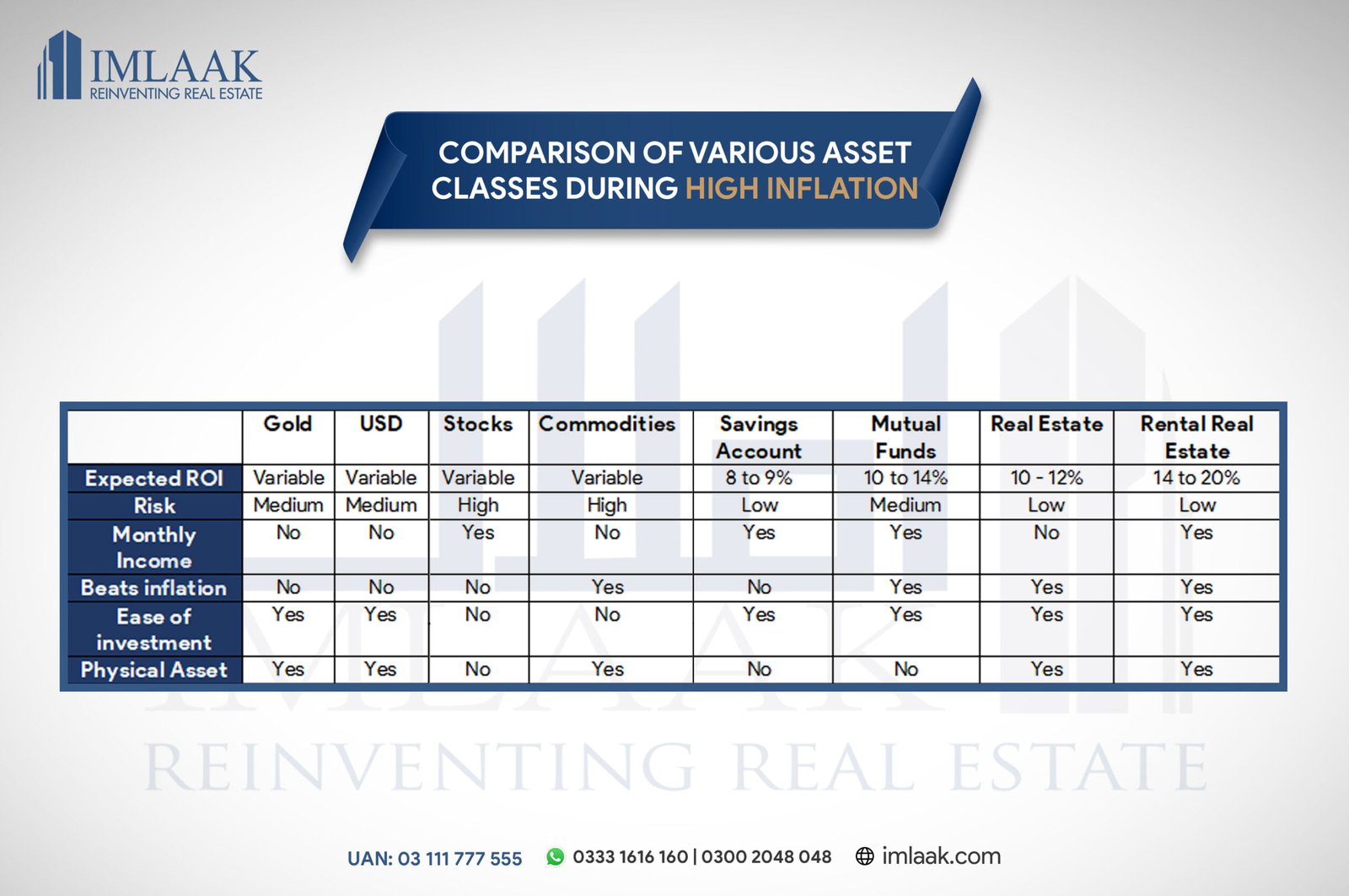

Today we will discuss some of the best investment options in Pakistan to hedge against high inflation. When inflation is high, we need to find out those asset classes which have a direct co-relation with inflation and can result in real returns on your investments.

The worst thing you can do right now is hold down your cash as in such economic times cash is trash.

So let us go through a list of a few options open to investors in Pakistan in the present scenario which may help them to hedge against the rising inflation.

1. Rental Real Estate Income

First and the best investment option in Pakistan is rental-generating real estate. This asset class has intrinsic value and provides consistent income through monthly rentals. It acts as a good inflation hedge since there will always be a demand for homes, regardless of the economic climate, and because as inflation rises, so do property values, and therefore the amount a landlord can charge for rent.

Argentina is a classic case study where rental income offers yields of up to 7 to 8%, despite its economic crises and regular defaults. The study reveals that as Argentina’s economy collapsed, the banks could not offer new mortgages, and therefore demand for rental property rose.

Although in Pakistan our housing sector is not really dependent on mortgage finance. However, in a troubled economy where people are not making enough money to afford a new house, the dependency on rental properties will increase.

Real estate is one of the time-honored inflation hedges. It’s a tangible asset, and those tend to hold their value when inflation reigns, unlike paper assets. More specifically, as prices rise, so do property values, and so does the amount a landlord can charge for rent so that the property earns higher rental income over time.

A good rental property in Pakistan will give you 14 to 20% returns per annum through capital gains and rental income combined. The rental income can be used to maintain your lifestyle and the capital gains will beat inflation in the longer run. All these elements make real estate the most valuable protection in inflationary times.

2. Mutual Funds

Mutual funds are described as pooled investments. When an investor buys the units in a mutual fund, the money is pooled with that of other investors whose goals are similar. A professional fund manager uses this money to buy stocks, bonds, or money market instruments that make up the fund’s portfolio of investments.

In Pakistan, various mutual funds are available and handled by professional investment managers. This is especially the best option for investors who do not have the funds to invest in the rental real estate market. You can easily open a mutual fund account with a bank and start your investment without having to invest a large amount of money upfront.

Although mutual funds are subject to market risk, they have shown solid and consistent growth in the past years. Some Mutual funds have shown 12 to 14% gains consistently over the years. This means that if everything goes well, they will successfully beat inflation and keep your wealth intact.

Another benefit of mutual funds is that some of them are shariah compliant and if taking a fixed interest is something you want to avoid, mutual funds can solve that for you.

Mutual funds could easily be the first step where you make your money multiply before you step into the big game of rental property.

3. Real Estate

Investing in non-rental real estate is still a good investment during inflation times. Real estate in Pakistan has generally given a capital gain of 10 to 12% per annum, which should beat the high inflation of today.

Real estate works well with inflation. This is because, as inflation rises, so do property values. This helps to keep pace with the rise in inflation. For this reason, real estate income is one of the best ways to hedge an investment portfolio against inflation.

Although the recent Government policies discourage investors to invest in plots and files or other non-rental properties. If you have knowledge of real estate and some holding power, you can effectively hedge against inflation. PKR depreciation is also easily managed by investing in real estate.

You may not see immediate results and you will require a bit of patience when working in Pakistan real estate. However, if you have invested in the right place, you will eventually beat inflation. Though, real wealth creation may not be possible anymore in non-income generating real estate.

4. Saving Accounts

Pakistani banks are offering one of the highest interest rates in the world right now, where you can put your money and get up to 8 to 9% returns. This would probably not make you wealthy but it will shield you to an extent against inflation. At least you are growing poor at a slower rate than those who are just keeping cash.

If you are not using the profits and keep compounding, you will probably still be able to afford in ten years what you can today. However, you need to have another active source of income to keep your lifestyle.

5. Commodities

Commodities are a broad category that includes grain, precious metals, electricity, oil, beef, orange juice, natural gas, etc. Commodities and inflation have a unique relationship, where commodities are an indicator of inflation to come. As the price of a commodity rises, so does the price of the products that the commodity is used to produce.

Fortunately, it’s possible to broadly invest in commodities via exchange-traded funds (ETFs). The returns on commodity trading are variable and will depend on your experience.

Before investing in commodities, investors should know they are highly volatile and I advise investor caution in commodity trading. Because commodities depend on demand and supply factors, a slight change in supply because of geopolitical tensions or conflicts can adversely affect the prices of commodities.

In the present geo-political scenario, global inflation, I expect commodities to perform well and rate them above stocks. A good trader will effectively beat inflation and create wealth, however as it is riskier and not for everyone, I rate it at No-5.

6. Stocks Portfolio

Although if you are a smart investor, you can certainly make some money and beat inflation when investing in stocks.

Stocks offer substantial upside potential in the long term. In general, businesses that gain from inflation are those that require little capital (whereas businesses that are engaged in natural resources are inflation losers). Both technology and communication services are capital-light businesses, so, theoretically, they should be inflation winners.

However, stocks are highly volatile in a country like Pakistan suffering political and economic turmoil, and therefore not something I will recommend.

Stocks are a good investment tool, but most people end up losing money instead of making money. It is therefore not something I will recommend in times of political and economic crises going on in Pakistan.

7. Dollar

If you have been holding cash and are fearful of investing it, considering that the USD has shown an average growth of 6% on a year-to-year basis against PKR, it might be wise to convert your PKR into Dollars. However, while it will safeguard you against PKR depreciation, it may not actually be a good hedge against an 11 to 12% inflation.

So while it is smart to keep your money in USD instead of PKR, it will not win the battle for you. If you are one of those who want to keep extra money at hand, besides your regular investments this is the right place to go. Especially for ex-pats who are being offered good interest rates by banks in Pakistan over their foreign currency bank accounts.

8. Gold

Gold has often been considered a hedge against inflation. In fact, many people have looked to gold as an “alternative currency,”, particularly in countries where the native currency is losing value. These countries utilize gold or other strong currencies when their own currency has failed. Gold is a real, physical asset, and holds its value for the most part.

There are better assets to invest in when aiming to protect yourself against inflation. But like any strong portfolio, diversification is key, and if you are considering to hedge against inflation Gold is worth looking at.

Recommendation

The general rule of thumb is that asset classes that hold a physical intrinsic value and offer regular income cash flow perform best in times of high inflation.

Captain (Retd) Shahnawaz Yaqub Bhatti

Investment Consultant and CEO at Imlaak

Mob : +92 333 1616160 ( Whatsapp)

Mob : +92 300 2048048 ( Whatsapp)

nice

Shangrila City offers attractive investment options to hedge against high inflation in Pakistan, as real estate historically appreciates in value and provides rental income, serving as a stable and tangible asset. Investing in this thriving community can be a prudent strategy for preserving and growing wealth amid economic uncertainties.

Greate