How rich people make easy money | Rental income solution by imlaak

How Rich People Make Easy Money

I am sure you’ve often wondered how some people just seem to succeed in life with minimal effort. And to some, it seems a constant struggle. Well, unless you’re lucky enough to be born into a billionaire family, most people spend their lives working hard to just get by. So why do some people always seem to get rich in life whilst others spend a lifetime chasing their fortune?.

At the moment, you are probably trading time for money. Most people’s jobs involve being paid for their time at a place of work, trading expertise for pay. Think of all the time it takes building a business, the time in an office, the hours answering calls, strategy meetings, networking, chasing clients. It’s exhausting and labor-intensive.

Why do the poor stay ‘poor’

So, we all know what poverty looks like when people can’t cover the basic expenses for life. They have difficult choices just to pay their rent or their bills. They spend their lives chasing money like a rat in a cage. Instead of investing in themselves and trying to improve their situation, they are reluctant to take risks and grab an opportunity because they are worried about the future. But the truth is most don’t feel equipped to face challenges and so can often vent their frustrations by blaming others – politicians, bad luck, and so on. The poor want wealth but they don’t know how.

Why does the middle-class stay ‘poor’

And then there’s the middle-class. They have disposable income and savings. They work hard and aspire to be rich. But they often never manage to quite make it onto that next financial level.

Imagine. You have disposable income each month. So you buy the latest tech, a new car, or a holiday to indulge yourself. And here is where you make a mistake that costs you the chance to get rich.

When things lose their value, this is called depreciation. And this is what drags you down. The tech will quickly go out of date. That nice watch is worth less than half as soon as you walk out of the store. The car will quickly lose it value. The holiday will be a distant memory. These are not good investment choices. You are trapped in a cycle of working harder and harder just to keep things as they are.

For a short-term gain, you lose the chance to get onto the next financial bracket and become truly wealthy. The car needs repairs. The technology needs replaced. You feel the pressure to maintain or even top your lifestyle. This lifestyle is costing you more and more money. When things cost you more in the future, that’s called a liability.

So how do you become rich?

Rich people make their money work for them, whilst poor people work to make money. Rich people learn to invest wisely in assets that are going to appreciate and give you a positive cash flow.

Paul Getty, the world-famous billionaire, famously stated,

‘The Key to wealth is to learn how to make money while you sleep’.

So, what is he talking about? Sounds like a fairy tale. Not at all. It’s a clever way to make money, and it’s called ‘passive income.

Passive income is a clever way to make money and free up your time. It is earnings from a rental property, limited partnership, stocks, shares, or other business in which a person is not actively involved.

Definition of asset and liability as per Robert Kyoski

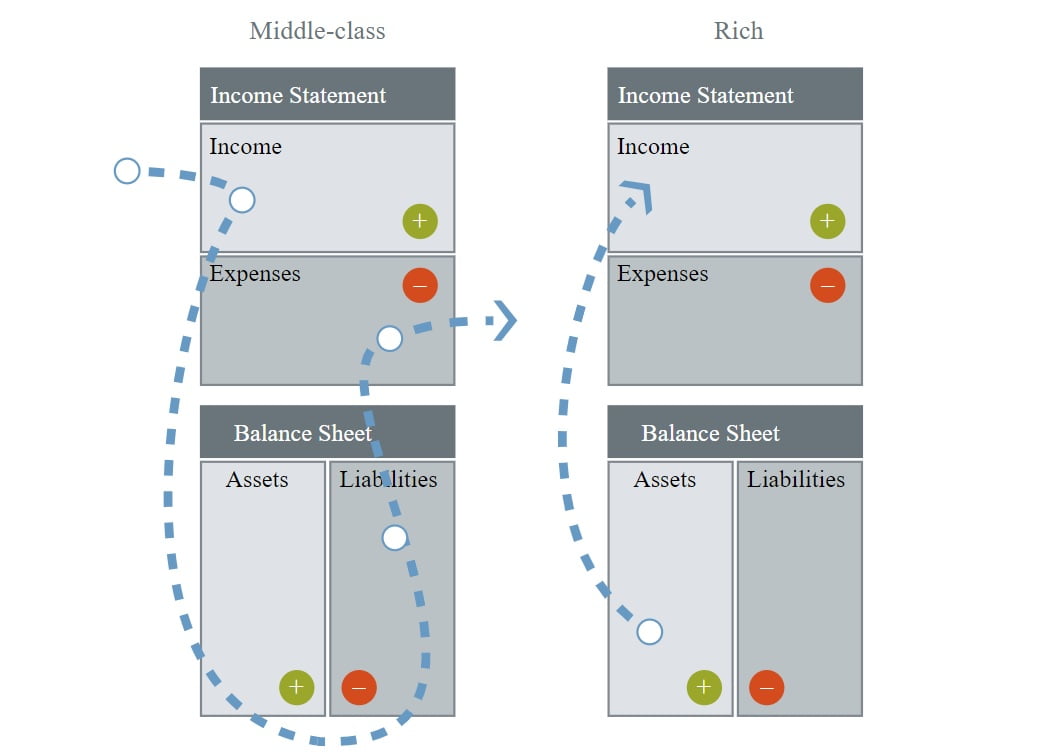

As Robert Kyoski explains in his book “Rich dad poor dad” the biggest mistake most of the middle-class make is that they keep acquiring liabilities believing that these are assets.

The asset is anything that increases in value and puts money in your pocket every month, giving you a regular cash flow.

Liability is anything that takes the money out of your pocket.

Your house for example is not an asset but a liability as per Roberts definition, the plots and files you have purchased are liabilities as well. You will pay for its maintenance, taxes, development charges, non-construction penalties. Only if you’re able to sell it at a profit does it become an asset or if they are being paid by your passive money. Until then, while they may increase in value over time and give you capital gains, which is not always the case, you are paying for them and that classifies them in liabilities.

Conversely, a rental property can be an asset, if you do your due diligence correctly and are able to collect more rent than you have costs each month. The difference between the rent and the expenses is the net operating income, and it is cash flow that flows into your pockets each month. Therefore, it is an asset.

I can tell you that cash flow is king. Assets don’t pay bills; cash does! Robert K’s definition of an asset is not accurate from an academic point of view, but for the purpose of defining the types of assets to focus attention on, he is spot on.

So, in truth, you can only call yourself wealthy if your assets are paying for your liabilities, expenses and also generating capital for you to acquire more assets. Now you don’t have to work for money but your money works for you.

Therefore if you keep collecting assets that are liabilities, you will keep paying for them until you die and while it seems that your net worth is increasing, it cannot pay for your monthly expenses or your lifestyle, and the profits are only realized when you sell it.

The safest investment rental property

Partnerships can sour. But property tends to rise steadily and can provide two revenue streams: rental and capital growth. If the market stagnates, you can always rent out a property and continue to make money ‘while you sleep’.

And which kind of passive income has the least risk? Rental Property, of course.

So the recognized safest route is to invest in real estate. As the old saying goes, ‘There’s nothing as safe as houses. With some expert help in the choice of an investment property, you can double your money. How? Because you can rent the property whilst it steadily increases in value. So you are literally making money as you sleep. And even better, you can invest your rental income from your assets and invest go after the next investment opportunity.

This is how rich people move up and up. They earn easy money on rental revenue, watch as their carefully chosen property also appreciates in value, and then go on to the next project. This kind of investment is called ‘passive income’– where there is an initial cost but then the revenue stream doesn’t require you to spend time slaving over it every day. It leaves you free to spend your precious time on an easy life, or search for the next opportunity,

Work Smarter NOT harder

You can’t help it if you weren’t born with a silver spoon in your mouth. You may have a ‘comfortable’ lifestyle but wonder how you can become truly wealthy. The lesson is you need to actively take a calculated risk. No one is going to offer it to you on a silver platter. You need to put in some initial time, money, and research and then sit back and enjoy the results. Invest in a property that will not just appreciate in value, but will also earn you rental revenue. You can use your assets to go on to your next project.

And then you can enjoy what it truly means to be wealthy.

Time is precious |Rental income solution by imlaak

It’s not about working 50 years of your life for a few years of retirement. Having the constant stress of being tied to your desk, to the phone, juggling investments, constantly watching the stock market returns.

Time is the only thing we can’t buyback. Passive Income is all about saving time. It’s about making smart investments that work for you in the background.; quietly gaining revenue. So you can spend your precious time making more money if you wish. Or enjoying your life to the full for as much time as Allah wills.

So what are you waiting for? Contact us now and become part of our smart rental property solutions, because we are imlaak and we are REINVENTING REAL ESTATE.

Captain (Retd) Shahnawaz Yaqub Bhatti

Investment Consultant and CEO at Imlaak

Mob : +92 333 1616160 (WhatsApp)

Mob : +92 300 2048048 ( WhatsApp)

Great Article, Middle class people buy luxuries & go for comfort instead of saving and investing money, they care more about people opinion than doing the right things.

:- Build assets, don’t acquire liabilities.

Thanks for educating us.