A Deep Dive into Real Estate Investment Mathematics of Fixed Rental & Capital Gains Projects

Real estate is frequently viewed as a secure and reliable investment option for the long term, with the potential for considerable returns and financial gains over the course of the investment. Over the past few years, construction projects are taking over the real estate sector, and a lot of new investment ideas have been generated by marketing companies to sell them and make them attractive for investment.

As a real estate consultant, I have been helping investors make wiser decisions through in-depth research and analysis to uncover the hidden secrets behind marketing strategies and investment plans. Marketing companies play a major role in shaping opinion by offering various investment ideas and plans, which include fixed rental guarantees or capital gains, short-term rentals, etc. Today I will compare two such investment plans side by side to find out which one is really worthy of your hard-earned money.

Fixed Income Projects/Investments

The set Rental Guarantee & Capital gains project is a popular investment model that is frequently presented to potential investors. This model offers a set rental income (typically about 10% per year) together with an attractive buy-back option on capital gains ranging up to 5% per annum.

In spite of the fact that these numbers might, at first look, appear to be quite appealing, a more in-depth comprehension of the financial computations and market dynamics involved reveals that these fixed-income projects might, in reality, produce lower rental yields and capital gains compared to the projects that offer an uncapped rental and capital gains.

Open Income Projects/Investments

The open-income projects allow the market to determine the rentals and the capital gains in the project. These projects offer organic growth that coincides with the market conditions and dynamics.

While there is no fixed guaranteed income on these projects, they offer much better returns, both in terms of rentals and capital gains.

A Comprehension of the Financial Consequences

The initial cost of investment is one essential component that would-be investors frequently fail to take into consideration. Flats with a fixed rental guarantee often have prices that are 30–40% higher than those of comparable open-income flats. Because of these exaggerated starting expenditures, the return on investment (ROI) will be substantially lower than expected, and the possible financial risk will increase in the event that the real estate market experiences a decline.

In addition, even though the profits from these projects appear to be guaranteed, the actual profits are sometimes quite low. According to patterns seen in the market in the past, the majority of open-income projects can generate capital gains of up to 30–40% annually in the first five years, and they can then sustain a rate of at least 15–20% annually in capital gains for the next five years. When examined, the capital gains that result from open-income projects are significantly higher than those that result from fixed rental guarantee projects.

Understanding the Math Behind Capital Gains and Rental Income

The mathematical formulas that underpin the fixed income project investments are home to a cunning and potentially catastrophic fallacy. In fixed-income projects, rental income and capital gains are determined by the amount of capital invested; in contrast, real estate building projects generally increase at a rate of more than 30 percent while they are being built. As a result, even without a rental guarantee, the actual rental income after construction is greater than the 10% that was guaranteed in the case of a fixed-income project.

Take, for example, the Goldcrest DHA Lahore complex as an illustration. There, flats that were initially purchased for PKR 16 million now produce monthly rents of over PKR 200,000 on a long-term basis and even higher on a short-term rental model. Debunking the misconception that one needs a set rental guarantee, this translates to a 15% yearly return on capital investment.

The Capacity Of Trading During Real Estate Cycles

Real estate like other investment tools is subject to investment cycles, In Pakistan we have seen that real estate will show tremendous growth of up to a 100% in a year or less during an uptrend cycle. A fixed-income project does not let you utilize this cycle as you are tied through an agreement.

Whereas in an open income project, you can utilize these cycles to your benefit and generate even higher ROI by trading through these cycles.

Let’s talk about the present scenario where inflation is rising rapidly, and construction projects will show pronominal growth in the coming years owing to rising construction prices. However, if you invest in a fixed-income project at this time, you will not be able to enjoy the rise in prices and rent in the next couple of years.

The Hidden Dangers Involved With Projects That Offer Fixed Rental And Capital Gain Guarantees

The fixed rental guarantee projects carry with them the promise of stability; nevertheless, they also bring with them an inherent risk in the form of dependence on a third party to fulfill their commitments. This danger is especially high in nations like Pakistan that have less developed legal frameworks or market dynamics that are less predictable.

In such a situation, it is absolutely necessary to select a project with great care, looking for one that provides good value for the money and is well-managed. Open income projects, particularly when managed by knowledgeable real estate organizations such as Imlaak, frequently present prospects for increased rental yields and capital gains without the dependence on a third party for the actualization of these returns.

Analyzing the Numbers: Fixed Income Projects vs. Open Income Projects

Now, for this example, let us consider that Mr. A and Mr. B both invest the same amount of money in a construction project. Although fixed-income projects offering rental guarantees are usually more expensive, for the purpose of this example we will consider that both projects have similar prices.

Mr. A invests 17 M approx in a rental apartment that guarantees 10% fixed rental income and 5% fixed capital gains per year.

Mr. B invests 17 M approx in an open-income project in a serviced apartment building offering Rental Management Solution.

ROI for Mr. A

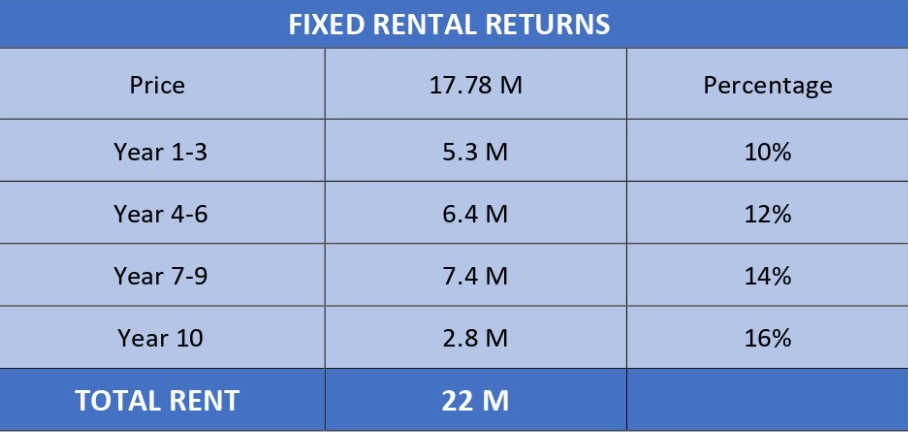

This investment is expected to generate a return of 256% over the course of ten years, taking into account a rental income of 10% for the first three years, 12% for the next three years, 14% for the next, and 16% for the last year. This results in a total return of PKR 21.6 million in rent.

Now the worst part is that these projects offer buyback at a fixed capital gain of only 5% per year, thus resulting in a total of PKR 8.86 million in capital gains, giving you an annual return on your initial investment of around 27%.

ROI for Mr. B

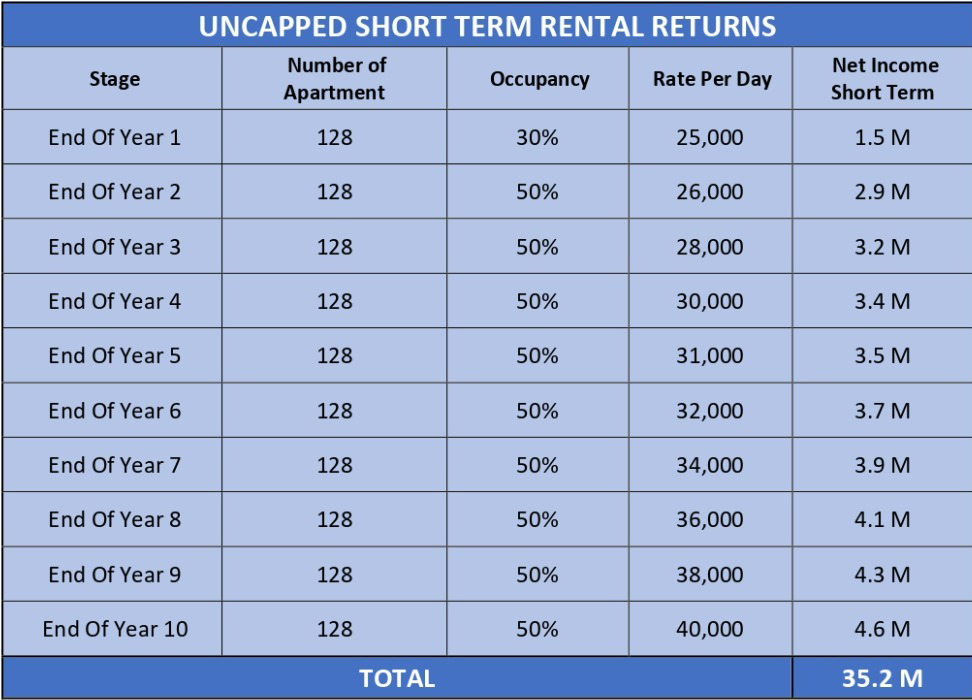

PKR 17 million invested in an open-income project has the potential to generate an astounding return of 47% per year over the same length of time. After ten years, the overall net worth would skyrocket to a staggering PKR 95.19 million if capital gains of PKR 42 million and rental income of PKR 35 million were factored in as under:

For the purpose of rental income, we have considered it to be a serviced apartment building such as Sixty6 Gulberg and being run on a pool-based short-term rental management model offered by imlaak. The occupancy and per-day rentals are calculated as per the average occupancy and prices of existing buildings in Gulberg Lahore.

Higher the rent higher the capital gains

So we can see clearly that Mr. B is a clear winner because HIGHER RENTAL INCOME = HIGHER CAPITAL GAINS.

Once your rentals are fixed so is your capital gain and the additional rents and capital gains over time are enjoyed by the companies and developers offering you such opportunities.

Past Performance

Finally, we need to see if the projects have followed a similar trajectory in the past and given more than 30 to 40% returns per annum.

The important thing to see is that the above returns are only calculated in terms of capital gains and rental returns are not taken into account. Surprisingly performance of all 3 projects is way better than the expected ROI from a fixed-income project even without rental income.

The truth is that a construction project gives you at least 60 to 70% ROI in 3 to 4 years when value is being added throughout the construction phase. This means that only in three years you will have more capital gains than what a fixed-income project promises you in 10 to 13 years.

You do not even need rental income to beat down the ROI of fixed-income projects

Once we take into account the rental income of these projects the ROI will exceed 35 to 40% per annum. This Is clear from our example above about rental return in Goldcrest apartments which reaches 15% even if rented out on a long-term basis.

Conclusion

- Projects offering fixed rental and capital gains are usually priced 30 to 40% higher.

- The initial higher price limits your capital gains.

- Rental income fixed on initial capital investment in fixed-income projects limits your rental growth.

- Limited rental growth in fixed-income projects further limits your capital gains.

- Companies offering such projects are just taking advantage of the insecurities of investors.

- You get higher rentals than 10% per annum even if you rent out on a long-term basis, thus completely eliminating the need for a rental guarantee.

- It is better to believe in the product rather than in companies or people when it comes to real estate as the life of real estate is greater than both and eventually, its value has to be ascertained by its own potential.

- Only invest in rental guarantee projects which offer value for money and do not take advantage of investors by raising the price much above its actual value.

- Never enter into a 10 years plus rental or lease model as it will eventually benefit the developer and not you. Even if you seek security its best to go for just a 3 or a maximum of 5 years rental guarantee models.

Shahnawaz Yaqub Bhatti

Investment Consultant and CEO at Imlaak

Mob : +92 300 2049944 (WhatsApp)

Mob : +92 333 1616160 ( WhatsApp)