Holy Grail of real estate RENTAL RETURNS – Part 1

Holy Grail of Real Estate RENTAL RETURNS

Real estate is booming in Pakistan and things look great after a long gap. In May of 2020, as soon as the Government announced a construction relief package, we were the first ones to predict this boon. Now that speculative trading is in full effect and prices have already gained 20%, I believe that rental income is the best source of developing passive income for the majority of you out there and can help you get rich faster than any other investment. Today we are going to talk about rental returns vs investment in plots, and find out which is better.

Prices have already taken a jump of at least 20% and the trickle effect is also seen in non-possession areas such as 9 prism which are not covered by this relief package. The reason being, relief package is not the only thing at play here. There are other factors involved as well such as:

- PKR has depreciated by more than 40% since 2018 and a price rise of 30 to 40% or even more is justifiable.

- Transfer costs have been cut down by half so investors are more confident in trading.

- Genuine interest by expats who are fearing or planning to come back to Pakistan amid job cuts or by choice post covid.

- Reduction in interest rates by state bank by almost 50%.

However, it is not as simple as it may look if you consider the following:

- The economy is not doing well, nor expected to, post-covid, neither in Pakistan nor globally.

- The construction relief package will end after Dec 2020 & black money inflows will stop.

- 68% of plots in possession are still unbuilt.

All of this can get pretty confusing and while speculative trading can bring huge returns, it has risks. What if things go downhill after 2020 and you get stuck again for a couple of years?

In order to make money out of real estate trading, you need to be pretty experienced and in good hands. In case you lose an upward cycle or catch it too late, you may risk getting stuck for years.

Let us have a look at Phase 7 DHA Lahore cycle for a better understanding:

Average Price in 2004 to 2005 7 Million

Average Price in 2006 to 2009 3 to 4 Million (Balloted in 2006)

Average Price in 2010 to 2011 4 to 6 Million (Excluding development charges)

The average price in 2012 to 2013 11 Million (Including development charges)

The average price in 2014 to 2020 15 Million

In the entire 16 year cycle, it has only given phenomenal growth from 2011 to 2013. The big QUESTION is how many of you were able to identify it and were able to enter the market at the right time and then exit at the right time?

The Holy Grail of Rental Returns

What if I tell you there is a much easier solution to making lots of money in real estate? Rental returns can save you from all the mess, speculation, risk, and getting stuck for long periods of time with little to no liquidity.

In order to understand it more clearly let us calculate returns on plots vs returns on rental property and this time we are going to do the calculations with the best performing phase of DHA Lahore ” Phase 6″.

The graph above shows the average prices of Phase 6, 1 Kanal plot from 2011 till August 2020. However, it does not show the exact picture.

The graph above shows the average prices of Phase 6, 1 Kanal plot from 2011 till August 2020. However, it does not show the exact picture.

To make things more interesting and challenging, let us consider 1 Kanal plot of Phase 6 in K Block over a period of 15 years with a rental property of the same value.

Average Price in 2005 to 2010 7 to 8 Million

The average price in 2011 to 2013 15 to 17 Million

Average price in 2014 to 2016 20 to 28 Million

The average price in 2017 to 2019 30 to 33 Million

Average price in 2020 35 Million

This is evident that plot prices doubled every 7 years approx, the first cycle of 2005 to 2013, took 8 years as we see prices move from 10 Million to 20 Million and then in next 7 years from 2013 till 2020 we are presently at 35 Million and may move towards to 40 Million in a year or so. However different investors will have different ROI, depending on the time they invested in DHA Lahore Phase 6.

It is easy to connect the dots backwards but very hard when trying to connect them moving forward.

So let’s do a backward calculation and leave no room for speculation. Let’s see what would be the outcome of the same amount of investment if done in 2005, which in this case is 10 Crores, if invested in a plot or if invested in a rental property.

Scenario 2005 till 2020 Example:

Investment in plots

13 x 1 Kanal plots in K Block in 2005 = 10 Crores

Worth of 13 x 1 Kanal plots in K Block in 2020 = 3.5 Crores

Net worth after 15 years = 45.5 Crores

Investment in rental property

10 crores invested in rental property would have paid you 5 Lacs each month = 6 Million in 1st year

Total rental returns & capital gains on rental income earned in 15 years = 40 Crores approx

Total capital gains at 10% per annum = 41 Crores approx

Net worth after 15 years = 81 Crores approx

In the table above, capital gains are calculated only at 10% per annum. Which in case of plots was calculated at 15% per annum in case of Phase 6 plots, considering they double every 7 to 8 years. Calculating rental property gains at a lesser rate of 10% also balances out any taxes you may be paying out from your rental income to keep things balanced.

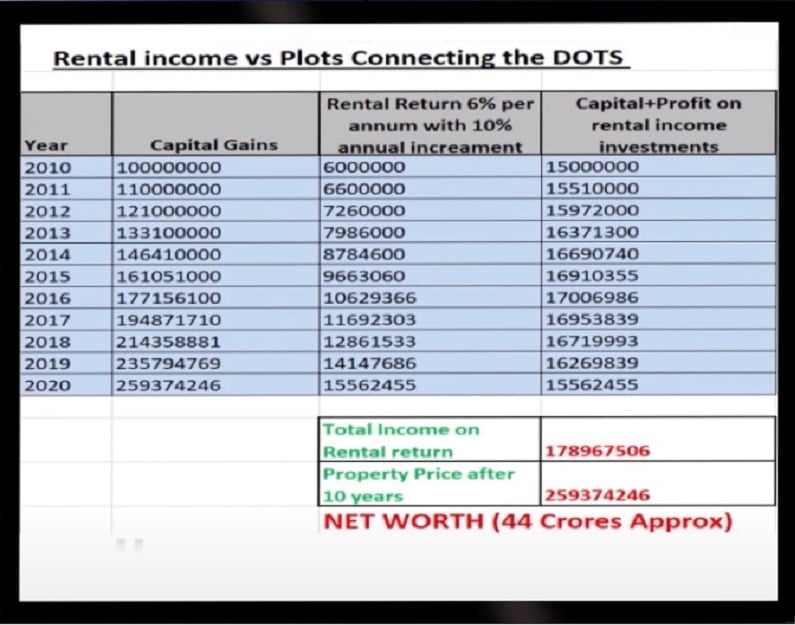

The 3rd column is rental income and is calculated at 6% per annum with a 10% increment per year which is the standard in most cases.

The 4th column is where things get really interesting. Here we are calculating the sum of the rentals collected per year, which are then further invested in real estate, and capital gain is calculated at 15% per annum for the balance years. So you are buying a 1 Kanal plot in Phase 6 almost every year from the rental you are collecting on your property. This should give you 15% profits every year on those plots for the remaining years.

Even if we consider we are not investing that rental money on buying plots. We still end up with a net worth of 62 Crores which is also significantly higher than investing in plots.

Even if we calculate the time period between 2010 to 2020, where Phase 6 just doubled in the next 2 to 3 years. The rental property still keeps the pace and gives almost 44 Crores in returns.

Also, remember that I gave plots a lot of edge by calculating the gain on rental property at a non-commulative fixed rate of 15%. Whereas in terms of plots they show a 15% cumulative gain after the prices doubled. To understand this if we calculate capital gains & rents received in the first year of our rental property they should be above 30 Million.

Scenario 2010 till 2020

The gain in plots almost remains constant adding a net worth of 45.5 Crores.

The gain in rental property still fares pretty constantly adding a total net worth of 44 Crores.

The Final Verdict

It is evident that long-term trading in plots is the least profitable. Now the arch rivalry is left between speculative trading and rental properties only. Speculative trading can do wonders for you, but it does not suit everyone and more than 90% of people fail. Rental property on the other hand has a success ratio of almost a 100%.

In the case of speculative trading, the house is the middle man, usually local investors with a lot of money, who enter and exit the market at the right times. Most of the people on the other hand end up losing patience and eventually money.

The wise thing to do is to develop your rental income and keep some money on the side for speculative trading opportunities. Consider it a bonus, not the other way around.

Captain (Retd) Shahnawaz Yaqub Bhatti

Investment Consultant and CEO at Imlaak

Mob : +92 333 1616160 ( WhatsApp)